The Cost of Workers’ Comp Insurance - How to Calculate Your Premium

February 13th, 2023 | 5 min. read

Accidents! And injuries! And illnesses!

OH MY!

As an employer, these are the obstacles you face on your yellow brick road to business success – and navigating the risk associated with workplace hazards can be even more frightening than any lion, tiger, or bear.

You know you have to purchase the right workers’ comp insurance to protect yourself and your employees from the expense of on-the-job incidents.

And you want to make sure, given any of the above obstacles, you and your employees are safe.

Ready to cut a check and call it a day, you realize that purchasing the workers’ comp coverage you need is not so simple.

Because the price of your insurance premium is determined by several complicated factors, the amount line on your check remains empty.

And puzzled by how to calculate the cost of your workers’ comp insurance premium, you – similar to the amount line on your check – draw a blank.

Here at Combined, our commercial insurance experts have guided countless employers toward finding the right coverage policy for their business. We want to help you with the intricacies involved in the process of purchasing workers’ comp insurance.

In this article, you will learn what factors affect the price of workers’ comp insurance and how to use them to calculate your policy premium.

By reading, you will have an in-depth understanding of the cost of your workers’ comp coverage.

What is workers’ comp insurance?

Workers’ comp insurance pays benefits to employees who suffer a work-related injury or illness. These benefits can include:

- Necessary medical treatment

- Ongoing care or rehabilitation

- Lost wages

- Funeral expenses

- Disability benefits

Workers’ comp insurance also protects you, as the employer, from facing legal repercussions following a worksite accident or injury.

Do you have to purchase workers’ comp insurance?

With very few exceptions, the answer to this question is, likely, yes.

However, workers’ comp insurance is regulated by the state. And, while many states require employers to carry workers’ comp insurance upon hiring their first employee, coverage requirements do vary by company location, size, and industry.

For example:

California requires all employers to carry workers’ comp insurance, Arkansas requires most employers with three or more employees to carry it, and Tennessee requires only employers with five or more employees or all employers in the construction and coal mining industries to carry it.

The National Federation of Independent Business’s (NFIB) state-by-state comparison of workers’ compensation laws can help you determine the workers’ comp requirement conditions for your business.

How much does workers’ comp insurance cost?

The cost of your workers’ comp insurance premium is based primarily on 3 factors.

Factor #1 – Employee classification rates

No matter the job, all employees are assigned class codes that estimate the level of risk associated with the work they perform. These class codes directly correspond to an employee classification rate, usually determined by either the National Council on Compensation Insurance (NCCI) or an independent state-regulated rating bureau.

If the class code references a high-risk job, the employee classification rate for it will be high. If the class code references a low-risk job, the employee classification rate for it will be low. This pattern applies to the full spectrum of occupational risk-to-rate relationships.

So, logically, a roofer would receive a higher rate than a warehouse worker and a warehouse worker would receive a higher rate than a secretary.

This risk-determined employee classification rate directly affects the cost of your workers’ comp insurance premium.

Factor #2 – Total payroll

When calculating the premium for your workers’ comp insurance policy, your total payroll also directly affects the cost of your coverage.

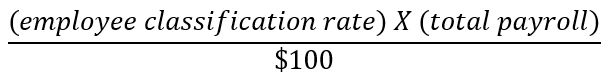

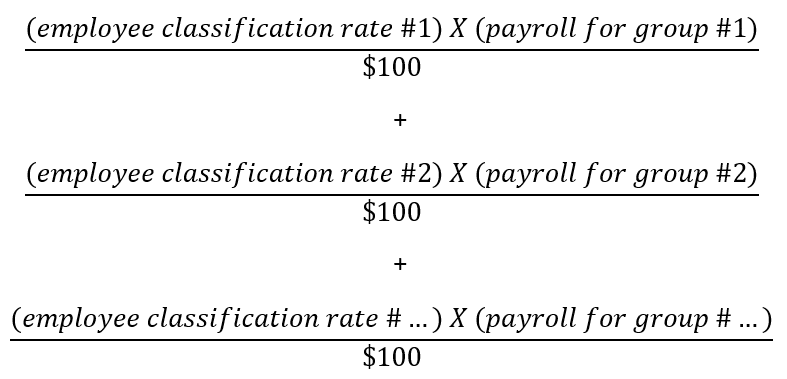

First, your total payroll has to be separated and grouped by employee classification rate. For each employee classification rate group, you pay that rate per $100 of that group’s payroll.

For Example:

If your business is powered by 20 employees with the same employee classification rate of $1, then you would pay $1 per $100 of your total payroll.

But, if your workforce is split into 15 employees with an employee classification rate of $1 and 5 employees with an employee classification rate of $5, your total payroll payment would be divided into:

- $1 per $100 of your payroll for the group of 15 employees classified at this rate

- $5 per $100 of your payroll for the group of 5 employees classified at this rate

Factor #3 – Experience modification factor

Your experience modification factor is like your company’s accident track record. It measures your claims history, taking into account the frequency, the severity, and the total cost of your past workers’ comp claims.

By comparing the actual losses of your past workers’ comp claims against the expected losses for similar businesses, the experience modification factor numerically predicts what the cost of your workers’ comp claims will be.

With an expected cost baseline of 1:

- If your

is 1 then your predicted cost is equal to the expected cost

is 1 then your predicted cost is equal to the expected cost - If your

is less than 1 then your predicted cost is less than the expected cost

is less than 1 then your predicted cost is less than the expected cost - If your

is more than 1 then your predicted cost is more than the expected cost

is more than 1 then your predicted cost is more than the expected cost

Now think like an insurance carrier:

Would you prefer to cover a business whose predicted cost is less than, equal to, or more than the expected cost?

You would prefer to cover the lowest cost business over the highest cost business.

This is because a business with the lowest potential loss is a better risk for an insurance carrier than a business with a higher potential loss.

The experience modification factor reflects this risk preference by directly discounting the workers’ comp policy premium for businesses with lower predicted costs. A lower experience modification factor results in a lower cost premium while a higher one means a higher premium.

How to calculate your workers’ comp insurance premium?

Now you have all the factors – what do you do with them?

First, you calculate the cost of your manual premium:

The cost of your manual premium is the product of your employee classification rate and your total payroll per $100 of payroll.

In the case of several employee classifications, your manual premium would be the sum total of the cost for each employee classification group.

Then, you calculate the cost of your workers’ comp insurance premium:

The cost of your workers’ comp insurance premium is the product of your manual premium and your experience modification factor.

![]()

In other words, the cost of your workers’ comp insurance premium is the product of your employee classification rates, total payroll, and experience modification factor per $100 of your payroll.

Next steps to the right workers’ comp coverage for your business

If you are here, you understand the dangers of day-to-day business operations and know how important it is to carry the right workers’ comp insurance policy.

But with confusing factors complicating the cost of that policy, the actual process of purchasing workers’ comp insurance can be daunting.

At Combined, we want to remove confusion and complication from this process. Our commercial insurance experts have assisted many employers with these challenges.

Our team is dedicated to helping you understand:

- Your workers’ comp insurance policy

- The cost behind the premium you pay for it

- How it feels to know that you and your employees are fully protected from the risk of workplace accidents, injuries, and illnesses

You now know what factors contribute to the price of your workers’ comp premium and how that cost is calculated. All that’s left to do is find your perfect policy!

Are you ready to feel the absolute assurance that comes with carrying the right workers’ comp insurance?

|

Schedule an appointment to get expert assistance finding your perfect workers' comp insurance policy! |

|

If you are not yet ready to speak with a team member, you may find these resources helpful: |

This article is not intended to be exhaustive nor should any discussion or opinions be construed as legal advice. Readers should contact legal counsel for legal advice.